It was just another Monday morning when David, the CTO of a growing e-commerce company, logged into his system—only to find a terrifying message flashing across his screen:

“Your files have been encrypted. Pay $500,000 in Bitcoin to regain access.”

Panic set in. The company had cyber insurance, but as David scrambled to contact their provider, he realized the process was far more complicated than expected. Filing the claim required weeks of investigation, compliance verification, and legal reviews—all while their business stood still. Customers were furious, revenue plummeted, and trust eroded overnight.

David thought cyber insurance would protect them. It didn’t. But what if there was a better way?

Why Cyber Insurance Alone Isn’t Enough

For years, businesses have relied on cyber insurance as their financial safety net against cyberattacks. But the reality is starkly different. Insurance doesn’t prevent breaches—it only provides reimbursement after the damage is done. And even that comes with hurdles:

- Lengthy Claims Process – Investigations can take months before a payout is approved.

- Limited Coverage – Most policies exclude incidents caused by human error or outdated software.

- Skyrocketing Costs – With cyberattacks rising, insurance premiums increased by over 79% in 2022 alone.

For David’s company, time was money. Waiting weeks for an insurance payout was not an option. He needed real-time financial protection—something that could prevent the attack in the first place.

That’s when he discovered cyber security warranties.

What Is a Cyber Security Warranty?

Unlike cyber insurance, which reacts after an attack, a cyber security warranty works proactively. It integrates directly with security tools like Microsoft Defender and endpoint protection systems, ensuring that if a cyberattack slips past defenses, an instant payout is triggered—no delays, no complex claims.

For David, this meant that if ransomware ever hit again, his company wouldn’t be stuck in limbo. They’d receive immediate financial support to restore operations.

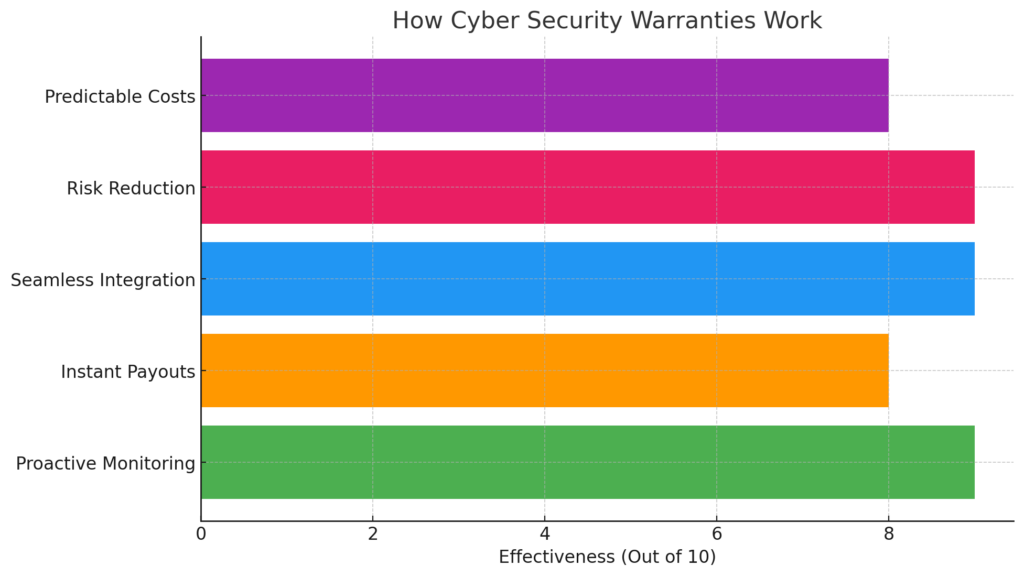

How Cyber Security Warranties Work

- Embedded Protection – Works alongside existing security tools, continuously monitoring threats.

- Instant Payouts – No need to wait for months-long insurance claims.

- Covers Security Failures – If a breach occurs despite protection, the warranty pays instantly.

This was a game-changer.

Why Cyber Warranties Are Becoming Essential

David wasn’t alone in facing these challenges. As cyber threats escalate, businesses are rethinking their approach.

Cyber Insurance Premiums Are Rising – And Covering Less

Cyber insurance is becoming more expensive while providing less coverage. Companies are now paying higher premiums for policies that don’t even cover the most common risks—such as human error, which accounts for 95% of cybersecurity breaches.

Cyberattacks Are Increasing at an Alarming Rate

David’s company wasn’t an isolated case. Cyberattacks have surged by 75% in the past five years, and businesses can no longer afford to wait for compensation when systems go down.

Breaking the Myth: Microsoft Defender and O365 Aren’t Enough

One mistake David’s team made was assuming that Microsoft 365 and Windows Defender would fully protect their data. While these tools offer strong baseline security, they follow a shared responsibility model—meaning businesses are still accountable for protecting their data.

Common Myths About Built-In Security

“Microsoft 365 automatically backs up all our data.”

Reality: Microsoft ensures platform availability but does not provide full data backup. You must back up your own files.

“Windows Defender is enough to prevent cyber threats.”

Reality: Defender provides solid protection, but it’s just one layer. Businesses still need endpoint security, threat monitoring, and response solutions.

Cyber warranties fill these gaps.

The Future of Cybersecurity: A Smarter, Faster Approach

David’s company implemented a cyber security warranty, and the difference was night and day. Instead of reacting to cyberattacks, they were now preventing them. And if a breach ever occurred, they’d receive instant financial support—without the frustration of insurance claims.

For modern businesses, cyber insurance is no longer enough. Cyber warranties provide the proactive protection companies need to stay ahead of threats.

Also Read: Veeam Ransomware Warranty: Key Features That Keep You Protected