It started with an email—then another, and another. Each one carried the same frustrating message: “We regret to inform you that your cyber insurance application has been denied.”

A small business handling customer data, transactions, and communications had done everything by the book. Firewalls were in place. Employees had been trained on basic cybersecurity protocols. Yet, every attempt at securing a policy ended similarly: rejection. The requirements were endless, the premiums skyrocketing, and the waiting period unbearable.

The business owner couldn’t shake the irony—wasn’t cyber insurance supposed to provide peace of mind? Instead, it felt like an exclusive club, open only to those with deep pockets and enterprise-level security measures.

But there was an alternative. One that didn’t just promise financial recovery after an attack but actively worked to prevent one in the first place. Yes, you guessed it right, we are talking about the cyber warranty.

The Reality of Cyber Insurance for SMBs

Cyber insurance was meant to be the answer to rising digital threats, a financial cushion in case of a breach. However, for small and medium-sized businesses, it was now becoming a luxury rather than a necessity.

Getting approved wasn’t just about filling out forms—it meant proving a level of cybersecurity that many SMBs struggled to maintain. Insurers required robust endpoint security, strict access controls, documented cybersecurity training, and regular audits. Even then, one wrong click by an employee, one missed software update, and a claim could be denied.

The challenges didn’t stop there for those lucky enough to get coverage. Premiums soared year after year, claims took weeks—sometimes months—to process, and policy exclusions left businesses wondering if they were even covered at all.

When an attack happened, the reality was harsh. Financial reimbursement didn’t undo reputational damage. It didn’t restore lost customer trust. It didn’t erase the downtime that could cripple an SMB overnight.

That’s when many began to realize insurance wasn’t enough. They needed something stronger, something more proactive.

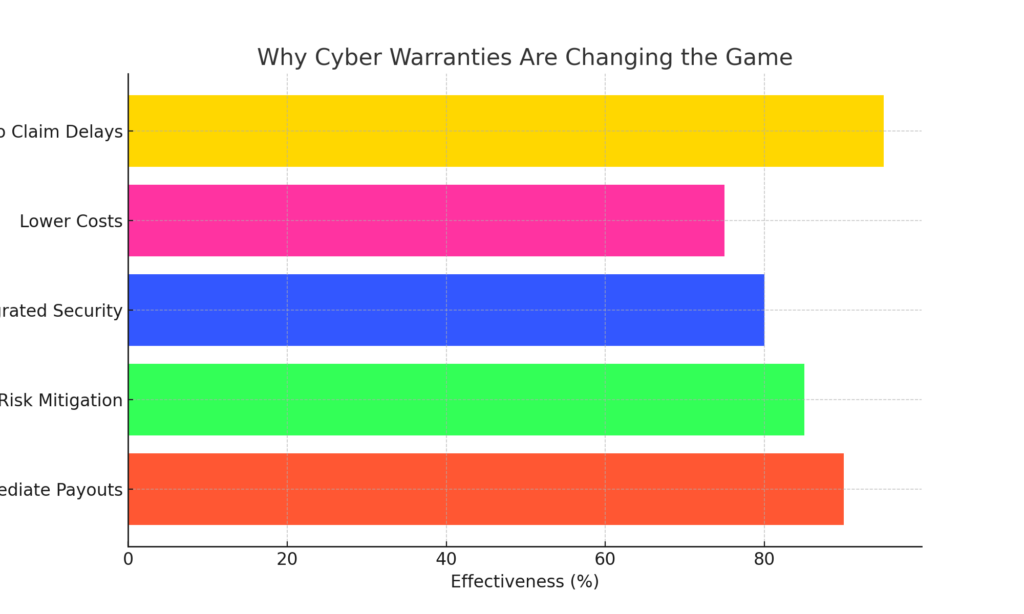

Why Cyber Warranties Are Changing the Game

A cyber security warranty isn’t just a backup plan—it’s a security-first approach that ensures businesses don’t have to deal with the aftermath of an attack in the first place. Instead of just covering financial losses, warranties actively work to reduce cyber risks, protect endpoints, and fill security gaps that SMBs often overlook.

Think about it like this: cyber insurance is reactive—it kicks in after disaster strikes.

Cyber security warranty coverage is preventative—it strengthens defenses so disaster doesn’t happen in the first place.

Many SMBs, especially those relying on Microsoft 365 (O365) and Google Workspace (G-Suite), assume they’re protected simply because they operate in the cloud. But cloud applications don’t secure endpoints—laptops, desktops, and mobile devices used to access sensitive business data which can lead to data breach.

A misplaced assumption that Microsoft backs up all data can lead to permanent loss when files are accidentally deleted or encrypted by ransomware. The belief that Windows Defender alone is enough to stop cyber threats leaves businesses vulnerable to advanced attacks that bypass traditional antivirus solutions.

This is where a cyber warranty becomes a game-changer. Instead of assuming that cloud security is enough, businesses get real, enforceable protection that covers their endpoints, enhances security protocols, and minimizes the risk of attack.

The Road to Future Cyber Insurance Approval

A cyber warranty is the perfect steppingstone for SMBs that still hope to qualify for cyber insurance. Insurance providers look for evidence of proactive cybersecurity measures, and a history of protected endpoints, reduced vulnerabilities, and active security management makes a business a strong candidate for coverage.

A business with a cyber warranty doesn’t just wait for an attack to happen—it proves that it takes cybersecurity seriously. When the time comes to apply for insurance again, it has a downloadable history of proactive security measures to show insurers that it’s a low-risk client.

Conclusion

Cyber threats aren’t waiting for businesses to catch up. Every day, SMBs are being targeted by ransomware, phishing attacks, and data breaches.

For businesses that can’t afford the complexities and costs of cyber insurance, the answer isn’t to go unprotected—it’s to choose a solution that actually works in the real world.

Cyber security warranty coverage isn’t just a product; it’s a modern, practical approach to cyber defense. It covers businesses, ensures security gaps don’t go unnoticed, and provides peace of mind without the endless fine print and denials.

Because in today’s world, being covered isn’t just about recovering from a cyberattack. It’s about making sure it never happens in the first place.

Also Read: Who Needs Cyber Fraud Warranty Coverage: Is It Right for You?